Part 1 of 2

Should your farm consider carbon credits?

It seems like every week brings another story about carbon credits for farmers. There are many factors to consider before jumping in and enrolling your farm in a carbon program. So what is a carbon credit? A carbon credit is created from a carbon offset, which is an activity that prevents the emission of carbon dioxide or another greenhouse gas to the atmosphere that would otherwise be emitted.

For example: If you decide to walk to the store instead of driving, the trip results in fewer carbon dioxide emissions, driving a car emits much more carbon dioxide than walking. Now, you could go up to a company or organization that wants to lower its net emissions and say, I can save three pounds of carbon dioxide by walking to the store. If you pay me fifty cents, I will walk to the store every day instead of driving and you will own the carbon dioxide savings that I generate from my changed behavior. This is a carbon offset. An organization has decided that it is easier for them to pay someone else to reduce their carbon footprint than to reduce their own.

Cap and Trade System

A carbon credit is a certified, tradable carbon offset that is exchanged under a cap and trade system of emissions regulation. Under a cap and trade system, companies are allotted a certain number of credits that limit how much carbon dioxide they can emit (the cap): 1 carbon credit equals 1 ton of carbon dioxide. If they emit less carbon dioxide than the credits they hold (by switching their fleet of vehicles to electric, for example) they can sell those credits to another company that wants to emit more carbon dioxide than their credits allow (the trade). In essence, this puts a constraint on the net or total amount of carbon dioxide emitted from those companies within the cap and trade system but gives companies the freedom to exchange those credits among themselves.

The US currently has no national cap on carbon dioxide emissions, therefore the federal government does not administer a national cap and trade program. California, however, has a state-wide cap-and-trade model with caps on greenhouse gas emissions declining over time. Regardless of the context, people often use the term carbon credit to refer to a voluntary carbon offset. Companies that wish to reduce their net carbon emissions due to internal choices or consumer pressures for more environmentally friendly products can say that they are offsetting the carbon they emit by purchasing the changed, carbon emission-reducing behavior of other entities.

Soil Carbon

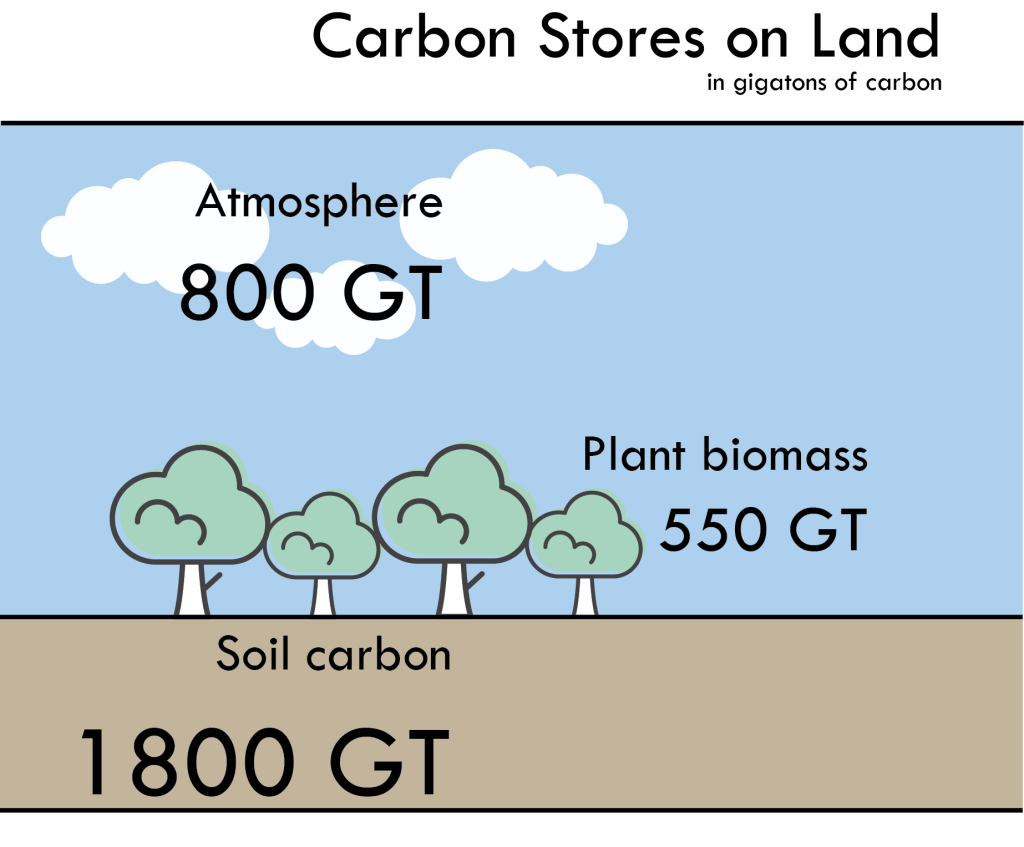

There is a lot of carbon stored in soils – almost three times as much as is in the atmosphere.

The increased amount of carbon in the atmosphere is what is driving climate change. Agriculture can help offset carbon emissions by moving some of that excess atmospheric carbon from the air to soils. Conversely, certain agricultural management practices release soil-stored carbon to the atmosphere. For example, tillage stimulates biological processes in the soil by introducing more oxygen and increasing the exposed surface area of carbon-storing compounds in the soil, speeding up the breakdown and emission of that soil carbon as carbon dioxide. On the other hand, there are practices that build up carbon reserves in the soil. Perennial crops that establish deep root systems deposit carbon in various layers of the soil. Cover crops grown between cash crops and crop residues returned to the soil can both lead to additions of carbon in the soil, for example. Given the vast reservoirs of carbon in the soil, and its ability to store carbon over time, there is a lot of excitement about the potential for certain land management practices like no-till and cover crops to generate carbon offsets.

Key players in the agricultural carbon market

- Farmer/landowner: The entity putting the practice in place that stores carbon or reduces/avoids carbon emissions

- Credit aggregator/creator/broker: The business or organization that serves as the go-between for the farmer and the eventual purchaser of the offset. They create and sell the offset. The end purchaser of the offset doesn’t want to have to buy carbon credits from thousands of landowners, so the aggregator does that and then sells the bundled credits to the purchaser.

- The credit aggregator pays either for a practice put into place on certain acres or pays for the carbon that is stored.

- Verifier: A separate entity that confirms that the practice is indeed storing carbon. There are several ways to do this:

- Model using computers that the practice in question, in this environment, with this management and soil type stores carbon

- Use satellite imagery to check that the practice is in place

- Take soil samples comparing baseline amounts of carbon in the soil at the start of the practice to samples taken after the practice has been in place for a set number of years to verify that carbon is increasing at the expected rate

- Purchaser: A company or entity that purchases the carbon credit to offset their emissions and “owns” the stored carbon.

There are a number of companies big and small that have begun signing on farmers for carbon offsets. The definitions laid out in this article are essential to navigating the carbon credit landscape in the United States, however, there are still a lot of questions about how these voluntary markets operate in agriculture and just how much responsibility the farmer bears for whether or not they are storing carbon. Part two of this article, Agricultural carbon credits: a deeper dive into key concepts for farmers and landowners, addresses issues like additionality and permanence that are central to carbon markets. Understanding these concepts and the questions they raise is key to determining if carbon credits are a good choice for a farmer’s operation.

Want to dive deeper into carbon markets? Check out this comprehensive overview of carbon markets by University of Wisconsin-Madison Professor of Business Development and Extension State Energy Specialist, Tim Baye.